Consumers Don't Think Brands Should Stop Advertising During the Pandemic

BrightcoveBrands are pulling or pausing their ad spending as the COVID-19 crisis puts a strain on their businesses, but new research shows that consumers may not want them to stop advertising altogether.

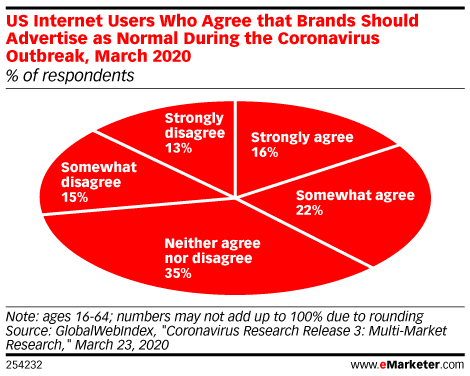

A March 2020 survey by GlobalWebIndex asked internet users in 13 markets whether brands should continue advertising as normal. Nearly four in 10 US respondents ages 16 to 64 agreed, and a similar share (35%) were neutral, compared with 28% who disagreed. (The global results were on par with those in the US, at 37%, 36% and 27%, respectively.)

In another March 2020 survey from Kantar , just 8% of consumers in 30 countries thought that stopping advertising should be a priority for brands. But 77% of respondents said they wanted advertising to “talk about how the brand is helpful in the new everyday life,” and 75% said it should “inform about [the brand’s] efforts to face the situation.”

That suggests that while consumers don’t expect brands to abandon advertising, brands should rethink their strategies. Campaigns that were planned pre-pandemic may no longer be appropriate as consumers clamor for information about how the crisis is being handled and how they can stay safe. That includes information about how brands are responding to COVID-19.

GlobalWebIndex’s research offered guidance on what those efforts should be. In the US, 80% of internet users agreed that brands should provide flexible payment terms, 70% said they should offer free services, and 66% said they should close nonessential stores. Another 59% of respondents agreed that brands should suspend normal factory production to help produce essentials.

Further evidence of consumer receptiveness to coronavirus-related brand messaging comes from advertising analytics company Ace Metrix . Research published in mid-March showed that 86% of US ad viewers were open to brands mentioning COVID-19 in their ads. More than four in 10 (42%) respondents said any mention was OK, which was roughly on par with the number who said it depended on the message or brand (44%).

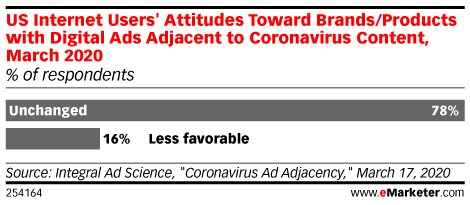

Brands that continue to advertise during the pandemic may be concerned about their ads appearing against coronavirus-related content. Those fears are understandable, but they may be unwarranted. In a March 2020 survey by Integral Ad Science (IAS) , 78% of US internet users said their view of a brand whose ad was adjacent to coronavirus coverage would be unchanged vs. just 16% who said they would have a less favorable opinion.

Despite consumers’ openness, advertisers should still tread carefully. As with other social or mission-based advertising tactics, companies can still get COVID-19 messaging wrong. Brands perceived as taking advantage of the situation or not taking it seriously may face backlash. In the Kantar study, 75% of respondents said that brands “should not exploit [the] coronavirus situation to promote the brand,” and 40% said they “should avoid humorous tones.”

This article originally appeared on eMarketer.com .